owner's draw in quickbooks self employed

A draw is simply a cash withdrawal that reduces the ownership investment you have made in your company. Also you cannot deduct the owners draw as.

This Group Is Designed For Small Business Owners Who Are Looking For Bookkeeping Suppo Business Basics Online Business Opportunities Small Business Bookkeeping

I own a small business and use Quickbooks Self Employed as a method of record and transaction keeping i do NOT use it for invoice generation.

. An owner of a sole. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. Business owners generally take draws by writing a check to themselves from their business bank accounts.

Step 4 Click the Account field drop-down menu in the Expenses tab. If you draw 30000 then your owners equity goes down to 45000. We managed three companies Ill focus on two of them since I dont think.

Self-Employed Sales Tax Recording. Start Your Free Trial Today. Ad See How QuickBooks Saves You Time Money.

A draw lowers the owners equity in the business. Click Chart of Accounts and click. Start Your Free Trial Today.

Were not drawing in permanent marker Depending on your business type an owners draw isnt the only way to pay. If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the. How do I record owner draws in QuickBooks.

You also pay self-employment taxes on an owners draw. Owners Draw on Self Employed QB. At the end of the year or period subtract your.

For accounting purposes the draw is taken as a negative from their business. However a draw is taxable as income on the owners personal tax return. The owner draws are recorded as negative entries against Equity.

QuickBooks Self-Employed costs 15month. QuickBooks Self-Employed QBSE does not have a Chart of Accounts where you can set up equity accounts unlike QBO. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Ad See How QuickBooks Saves You Time Money. You are to set aside money for state federal and self-employment taxes as you will be required to make. Select Petty Cash or Owners.

How are owner withdrawals taxed. QuickBooks Online ranges from. The draws do not include any kind of taxes including self.

An owners draw is not taxable on the businesss income. Type the owners name if you want to record the withdrawal in the Owners Draw account. The QuickBooks Self-Employed TurboTax Bundle is 25month.

Owners equity is made up of. The owners draw is the distribution of funds from your equity account. Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers.

There are limits to what it can do however. Technically an owners draw is a distribution from the owners equity account an account that represents the owners investment in the business. How to Record Owner Draws Into QuickBooks Click the List option on the menu bar at the top of the window.

For background our company used Quickbooks Enterprise for quite some time until 2017 last version we bought. Any money an owner draws during the year must be recorded in an Owners Draw Account under your Owners Equity account. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers. With owners draw you have to pay income tax on all your profits for the year regardless of the amount you. This leads to a reduction in your total share in the business.

Double Entry Accounting Has Come To Freshbooks Small Business Accounting Accounting Double Entry

Solved Owner S Draw On Self Employed Qb

6 Essential Words To Understanding Your Business Finances Bookkeeping Business Small Business Bookkeeping Small Business Finance

How To Pay Invoices Using Owner S Draw

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sche Small Business Bookkeeping Business Expense Small Business Accounting

Business Budget Template Business Expense Expense Sheet

Establishing And Marketing Your Own Business Can Be Overwhelming But It Doesn T Have To Be Follow These 6 S Bookkeeping Business Llc Business Business Tax

Free Sample Profit And Loss Statement Template Profit And Loss Statement Small Business Bookkeeping Bookkeeping Business

How To Record Owner Investment In Quickbooks Updated Steps

How To Write A Tax Write Off Cheat Sheet Business Tax Tax Write Offs Small Business Organization

Pin By Jessica Pulliam On Taxes In 2022 Quickbooks Online Money Saving Tips Lettering

Quickbooks Self Employed Basics For Business Owners Online Sponsored Quickbooks Social Media Design Graphics Business Owner

Freshbooks Review 2018 Try Cloud Accounting Software Free For 60 Days Careful Cents Freshbooks Accounting Software Small Business Accounting

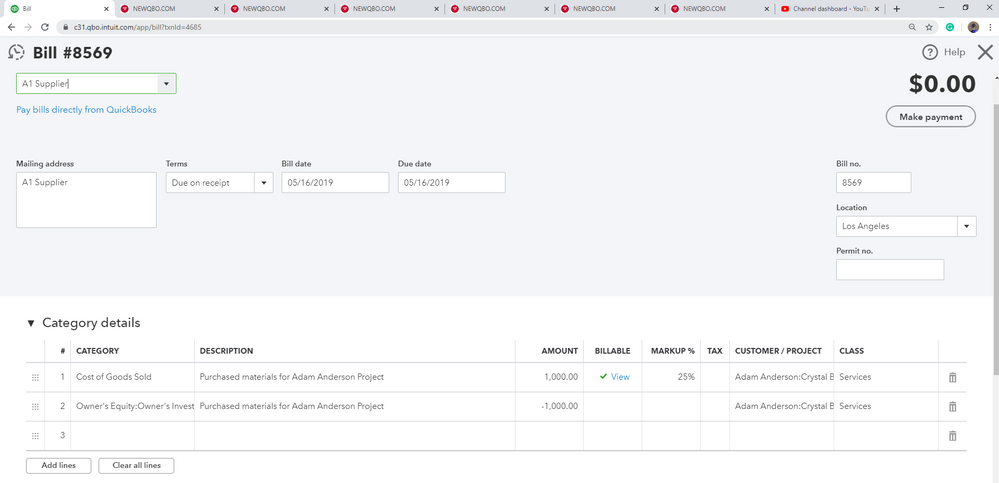

How Do I Make A J E With A Cr To Owner S Draw And Properly Record It In Cog Sold I Am Using Qbo Adv I Bought Items With My Personal Money That

Solved Owner S Draw On Self Employed Qb

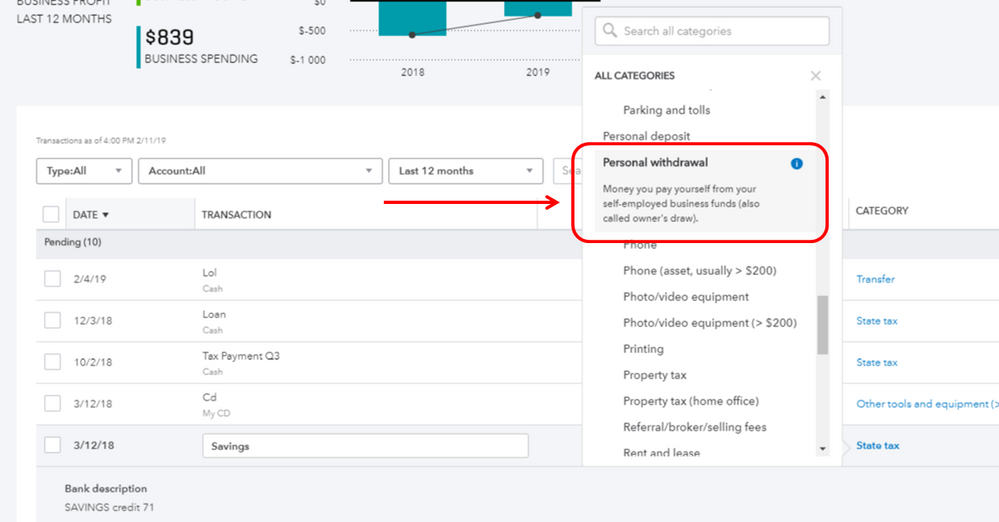

Setup A Draw From Quickbooks Self Employed

Rainbow Resourcegrammar Punctuation Grade 5 Superlative Adjectives Nouns And Pronouns Finding A New Job

Tax Vat For The Airbnb Hosts Go Self Employed Small Business Tax Business Tax Business Checklist