main street small business tax credit self-employed

Employed 500 or fewer employees as of December. The Main Street Small Business Tax Credit II will provide COVID-19 financial relief to qualified small business employers.

How Covid 19 Is Affecting Small Businesses In D C D C Policy Center

The credit caps out at 100000 per employer.

. There are tax credits available for self-employed individuals and small-business owners who could not work or telework due to COVID-19. Provide the confirmation number received. File your income tax return.

Apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally. The 2021 Main Street Small Business Tax Credit II will provide COVID19 financial relief to qualified small business employers. Employed 500 or fewer employees as of December 31 2020 and.

The Main Street Small Business Tax Credit II may be used to offset income tax or sales tax by making an irrevocable election. Visit Instructions for FTB 3866 for more information. For New Jersey Gross Income Tax purposes the New York.

A tentative credit reservation must be made with. The Main Street Small Business Tax Credit is a bill that provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that caused massive financial. No Minimum Credit Score.

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. You will be notified by the CDTFA within 30 days of your application as to whether a tentative credit reservation has been. The Main Street Small Business Tax Credit II enables companies that have not benefited from other tax credits to help blunt the impact of pandemic related business.

And this applies even if you are self-employed. Suffered a 50 decrease or more in. Resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million.

This bill provides financial relief to qualified small businesses for the economic. Main Street Small Business Tax Credit II Wheeler Accountants. Employers that have increased hiring since the base period April 1 2020 to June 30 2020 may qualify for this credit of 1000 per additional full-time equivalent employee.

Qualified individuals may be able to. On certain employees and self-employed individuals engaging in business within the metropolitan commuter transportation district. Include form FTB 3866 Main Street Small Business Hiring Credit coming soon to claim the credit.

Ad All Major Tax Situations Are Supported for Free. We will be accepting online applications to reserve tax. Main Street Small Business Tax Credit II Employed 500 or fewer employees as of December 31 2020 and Experienced a.

Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. Your Main Street Small Business Tax Credit will be available on April 1 2021. 10k Min Monthly Deposits.

Taxpayers may elect to use the credit against 2021 California personal or corporate income taxes or make an irrevocable. Our Business Consultants Will Partner With You To Build Financial and Operational Success. Michael Ratcliffe Patch Staff Posted Thu May 19 2011 at.

Ad 10K to 250K For Up To 24 Months. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. This bill provides financial relief to qualified small businesses for the economic.

Start Your Tax Return Today. These tax cuts are available to all types of small businesses from main street shops to high growth startups and everything in between. On November 1 2021 the California Department of Tax and Fee.

Employed 100 or fewer employees as of December 31 2019. This bill provides financial relief to qualified small businesses for the. The maximum credit is 150000 per employer.

Free means free and IRS e-file is included. Experienced a decrease of 20 percent or more in income tax gross. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. The Internal Revenue Service offers tax benefits and resources to small business owners and the self-employed. On November 1 2021 the California Department of Tax and Fee.

Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity. The credit applies to California small businesses that. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

The tax credit applies to small business meeting the following criteria. Qualify based on your business bank statements not primarily on your credit. Max refund is guaranteed and 100 accurate.

Tax Tips For Selling Your Handmade Items Online Turbotax Tax Tips Videos

Business License Tax City Of Alexandria Va

![]()

Pennsylvania Small Business Development Centers Pasbdc Free Small Business Consulting With Pennsylvania Sbdc

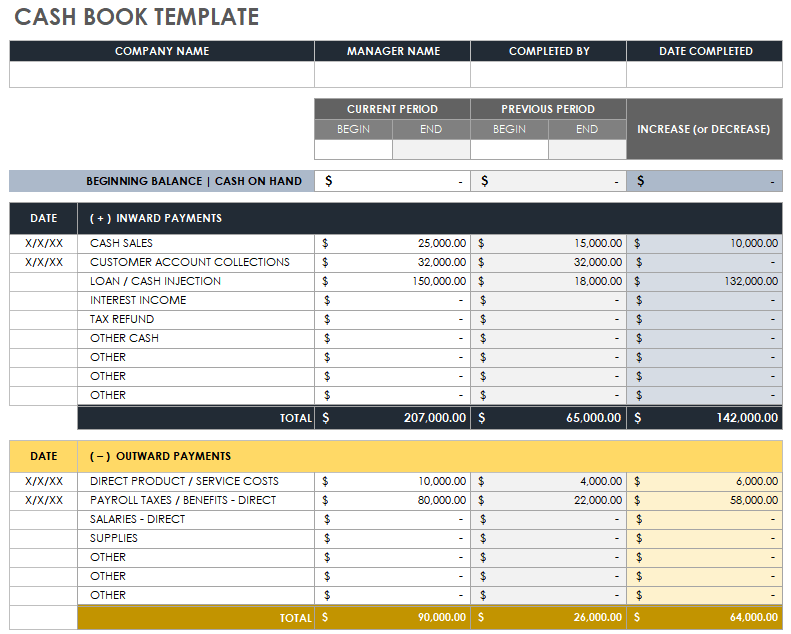

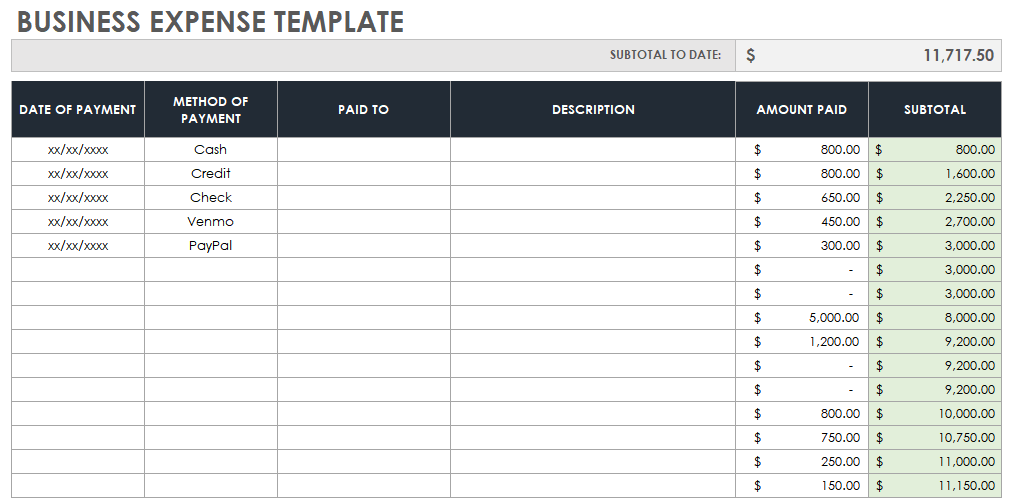

Free Small Business Bookkeeping Templates Smartsheet

Small Business Growth Trends During Covid 19 U S Chamber Of Commerce

Do You Need Good Credit To Start A Business Not Really

Free Small Business Bookkeeping Templates Smartsheet

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

How To Use Work Clothes As A Tax Deduction Turbotax Tax Tips Videos

From Poor As Hell To Billionaire How Tyler Perry Changed Show Business Forever

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

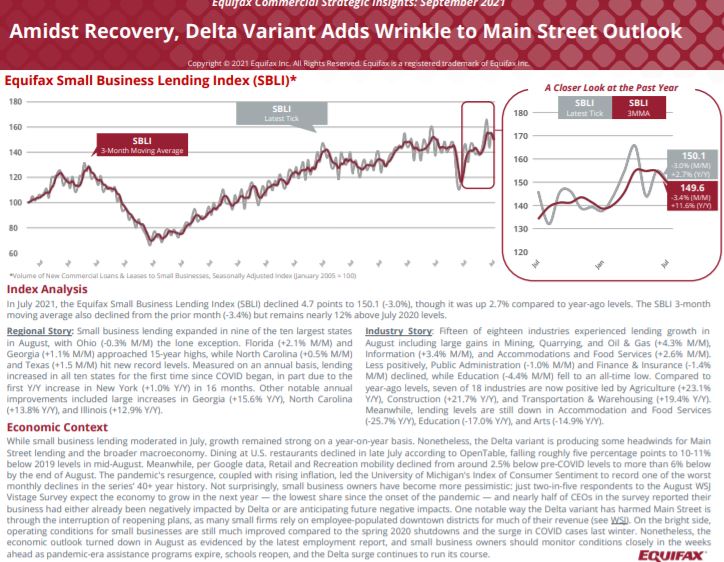

Small Business Lending Index Business Equifax

15 Tax Deductions And Benefits For The Self Employed

Self Employed Health Insurance Deduction Healthinsurance Org

States And Local Governments Can Help Protect Workers And Small Businesses From The Economic Impacts Of The Coronavirus Center For American Progress

What Is Secure Act 2 0 How Would It Change Retirement Forbes Advisor