tax abatement definition government

Such arrangements are known as tax abatements. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

. Whether revitalization efforts will ultimately prove successful is a big. Typically governments will offer tax abatements for a. If the IRS has assessed a.

A governing body may use an abatement sometimes called a tax. 77 Tax Abatement Disclosures that will require those state and local. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic.

Property Tax Abatement Act Tax Code Chapter 312 Overview. Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file. The most common ad valorem taxes are property taxes levied on.

Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location. A reduction in the amount of tax that a business would normally have to pay in a particular.

Section 40-9C-1 through Section 40-9C-8 Code of Alabama 1975. The City of Clevelands Residential Tax Abatement program is the temporary elimination of 100 of the increase in real estate property tax that results from certain eligible. Penalty abatement is a federal relief program designed to help those whove made a mistake and have incurred penalties.

The tax abatement is an incentive to encourage people to redevelop and move into these areas. An abatement is a tax break offered by a state or local government on certain types of real estate or business opportunities. Chapter 9C of Title 40 also known as the Brownfield Development Projects gives cities and counties the authority to.

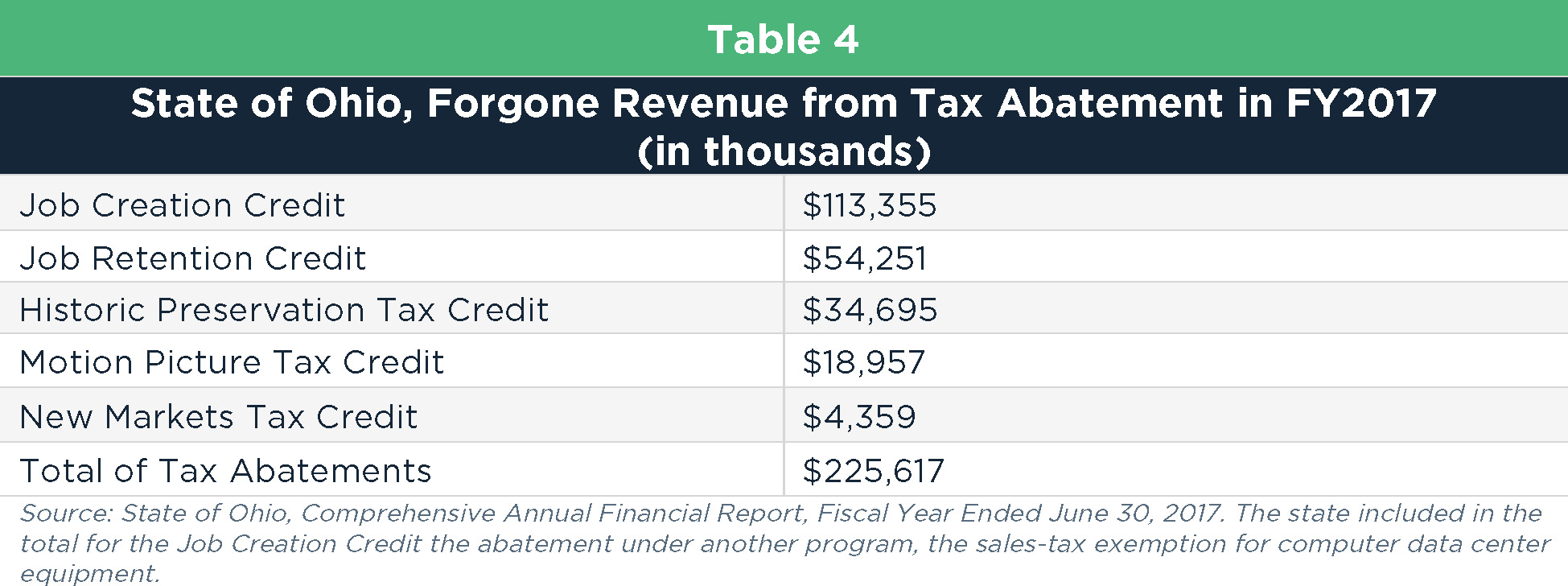

Recently the GASB published GASB Statement No. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development. Tax Penalty Abatement.

A tax abatement is when your tax obligations are reduced and in some cases eliminated for a certain period of time. More from HR Block. Abatements can range in length from a few.

Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by. What are Tax Abatements. A tax abatement is a local agreement between a taxpayer and a taxing unit that exempts all or part of the increase in the.

Gasb Rules Most Tif Spending Will Remain Undisclosed Good Jobs First

Local Tax Abatement In Ohio A Flash Of Transparency

Am I Eligible For Tax Abatement

Am I Eligible For Tax Abatement

What Is A Tax Abatement Smartasset

Penalty Relief Due To First Time Abate Or Other Administrative Waiver Internal Revenue Service

Tax Abatements Alabama Department Of Revenue

How To File For A Personal Property Tax Abatement Boston Gov

What Is A Tax Abatement Smartasset

Nyc Tax Abatements Guide 421a J 51 And More Prevu

.png)

Property Tax Abatement Program

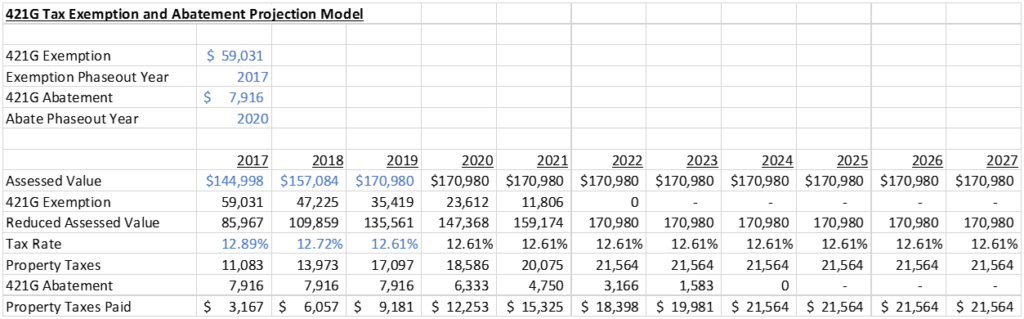

What Is The 421g Tax Abatement In Nyc Hauseit

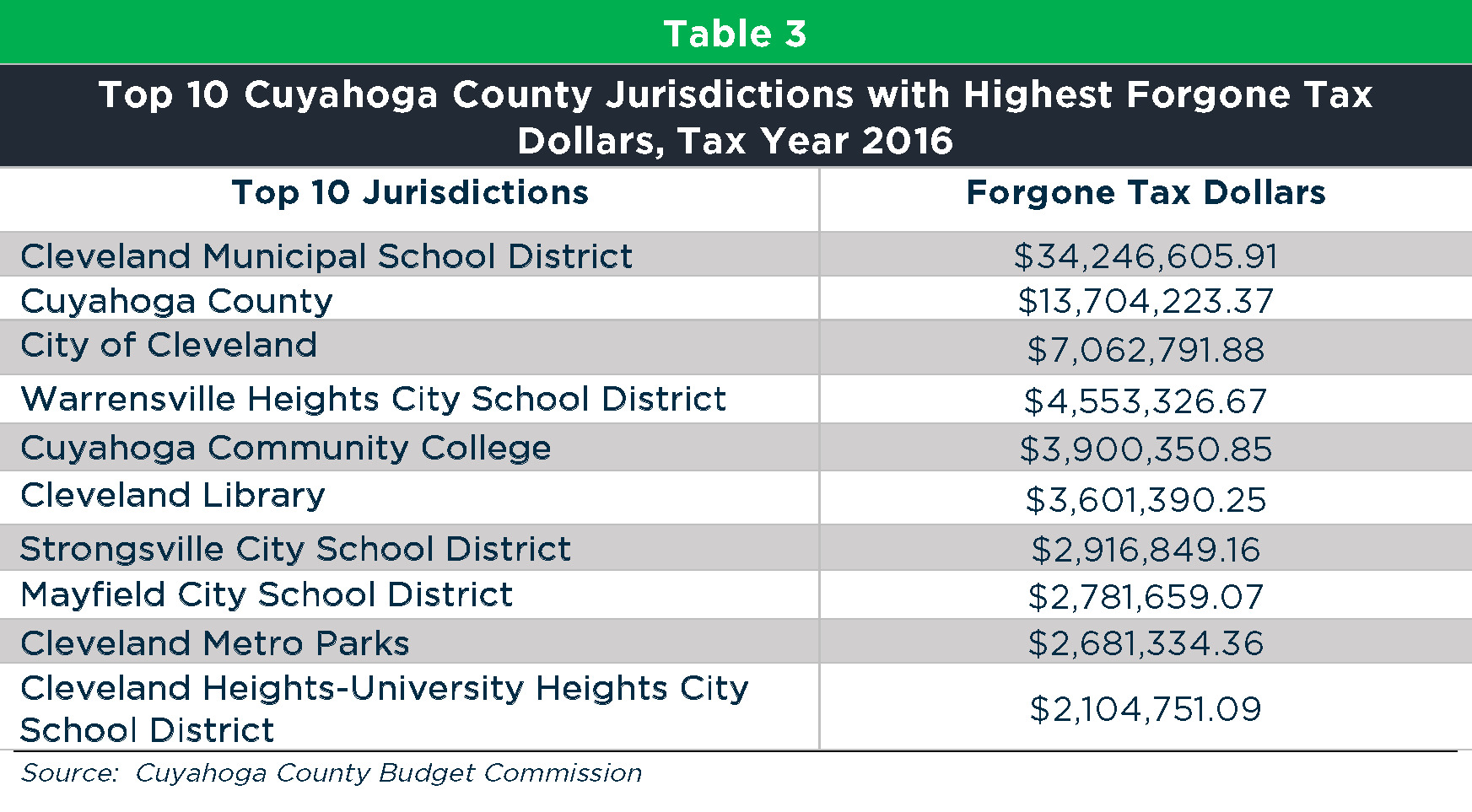

What Are Tax Abatements And What Must State And Local Governments Disclose In Financial Reporting Community And Economic Development Blog By Unc School Of Government

Local Tax Abatement In Ohio A Flash Of Transparency

Reduce The Taxes You Owe When You Buy A Home Front Door

Understanding California S Property Taxes

:max_bytes(150000):strip_icc()/GettyImages-1351333930-c16be1d0252a4a798f08cfb753f744fb.jpg)